EnergyQuest has just released its Australian LNG Monthly for May 2022. The lead article is:

If you pull the trigger, be careful you don’t shoot off your foot

Amid the east coast electricity crisis there are strident calls for the federal government to limit Gladstone LNG exports to divert gas to the domestic market. “We should tear up contracts to get access to our gas.”

However, it is much more complicated than that. While east coast spot gas prices spiked in May, Gladstone LNG exports actually fell, from 2.1 million tonnes (Mt) in April to 1.9 Mt in May. In fact, in May the Gladstone LNG projects were only operating at an average 86% of nameplate capacity, down from 96% in April. Of a total 29 LNG cargoes from Gladstone in May, industry sources estimate that 27 cargoes were delivered under long-term contracts, with only two spot cargoes in May.

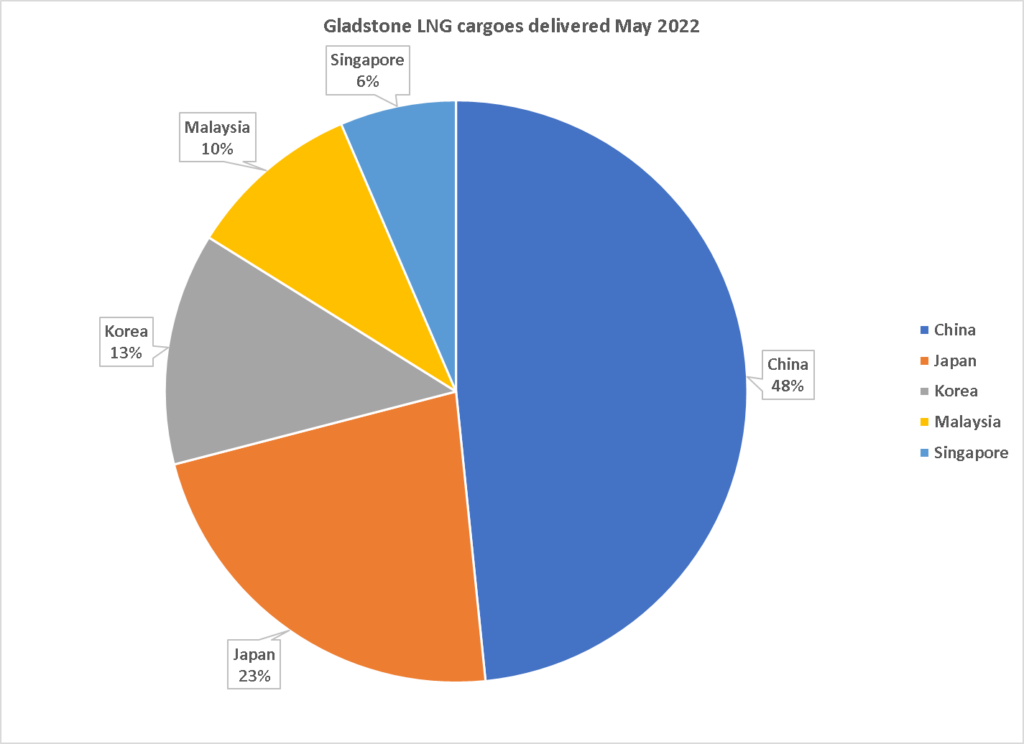

Figure 1 Gladstone LNG cargoes delivered May 2022 Source: EnergyQuest

Figure 1 shows the destination of cargoes from Gladstone in May, with 48% to China, 23% to Japan, 13% to Korea, 10% to Malaysia and 6% to Singapore. In April we estimate that 30% of all the LNG imported by China came from Gladstone. Any desire to redirect gas to the domestic market that is already contracted by one of these countries under long-term contracts obviously needs to be handled with extreme sensitivity, as appears to have been the case with the introduction of the Australian Domestic Gas Security Mechanism.

The situation is further complicated by the fact that the major buyers have already invested in developing the fields from which they expect to receive their supply. The Chinese companies CNOOC and Sinopec have shares of 50% of QCLNG Train 1 and 25% of APLNG respectively. Petronas and Kogas have 27.5% and 15% shares respectively in GLNG. They have already made substantial down payments on the gas they have contracted. The gas is not ours; it has already been sold. They are also investing hundreds of millions of dollars a year to maintain supply. Fifty percent Chinese owned Arrow Energy is doing the same.

That is not to say that there is not scope to direct more gas south from Queensland to alleviate the current crisis with coal generator outages. However, the options need to be carefully assessed with a full appreciation of the international ramifications.

Information about the EnergyQuest Australian LNG Monthly is available by clicking here.