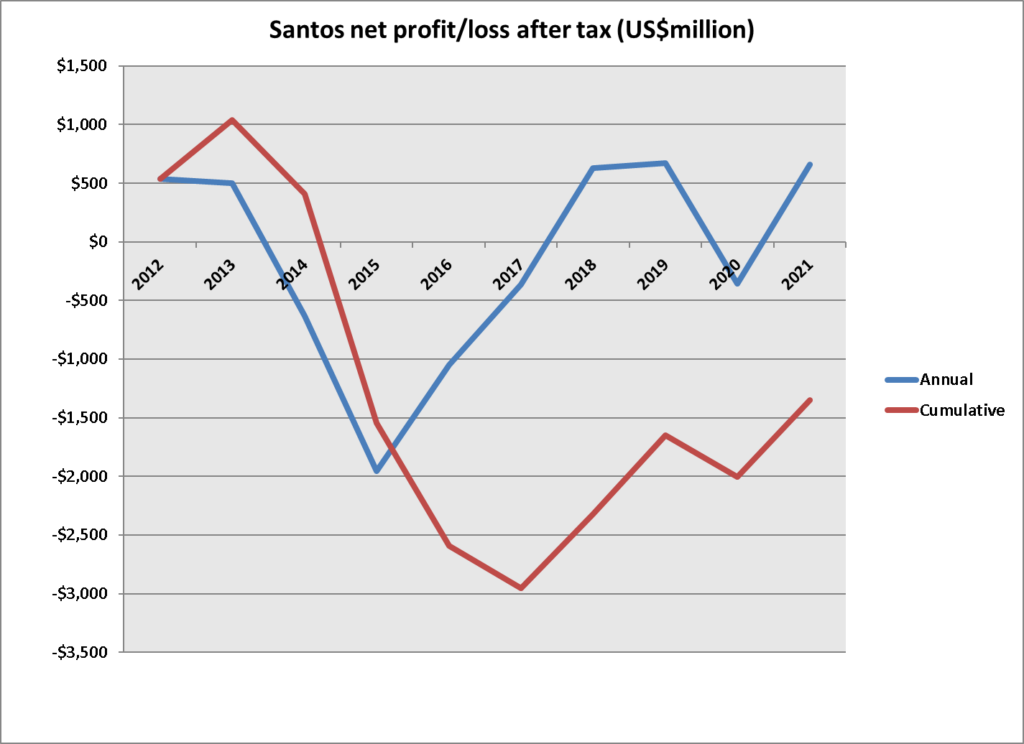

With all the talk about LNG super profits and why not tax LNG to subsidise domestic energy (i.e. subsidise fossil fuels, wasn’t there something about this at COP 26?) we though we would look at the 10-year financial performance of Santos as an example of an Australian company heavily involved in LNG. Between 2012 and 2017 the cumulative loss was nearly US$3 billion. Since then they have been gradually digging their way out of this hole but the cumulative result over the last 10 years to 2021 is till a loss of US$1,347 million. No matter how well they do this year they are still unlikely to turn this into a cumulative profit. Not much sign of a super profit here.

Source: Santos Annual Reports